– Cryptocurrency ETFs track a single or a basket of various digital tokens. Efiling Income Tax Returns(ITR) is made straightforward with Clear platform. Just upload your form sixteen, claim your deductions and get your acknowledgment number online. You can efile revenue tax return in your revenue from salary, home property, capital positive aspects, business & profession and income from different sources. Further you could also crypto index fund file TDS returns, generate Form-16, use our Tax Calculator software program, claim HRA, verify refund standing and generate lease receipts for Income Tax Filing.

Stop Worrying About Timing The Market

The risky nature of cryptocurrencies and no higher and decrease circuits like shares can also give a very lethal downfall. Unlike mutual funds, cryptos are very unstable and don’t have any limit. Over the last few years, mutual fund investments have been on the rise, and persons are moving in path of current investments rather than those conventional investments corresponding to FDs. Cryptocurrency vs mutual funds, in accordance with consultants, mutual funds are a significantly better investment for the long run. It operates independently of central authorities, like banks. It’s a worldwide payment community that allows customers to ship and obtain funds directly from one another.

Crypto Index Funds Streamline Investment But Pose A Problem To Ideas Of Blockchain Know-how

The content of this web site is copyright-protected and is the property of Piramal capital and housing restricted. The methodology of fee influences the time it takes for a deposit to clear. The majority of the indexes shall fall under one of many two categories based on their building. The use of this web site and the content material contained therein is ruled by the Terms of Use.

Icici Prudential Nifty Smallcap 250 Index Fund Direct – Progress

In essence, both shares and cryptocurrencies offer benefits and downsides to merchants and buyers. Stocks, backed by tangible property, offer security through regulation, potential dividends, and a stable market presence. On the opposite hand, cryptocurrencies entice with the potential for high returns, continuous market entry, and publicity to technological advancements.

Crypto Index Funds: Investing At The Cost Of Blockchain Ethic

Typically, crypto exchanges levy fees ranging from zero.1% to 1% per commerce. Set up in 2018, Bitget stated it serves over forty five million customers in over 150+ countries, offering real-time access to Bitcoin price, Ethereum worth, and other cryptocurrency costs. Save taxes with Clear by investing in tax saving mutual funds (ELSS) online. Our experts counsel the best funds and you can get high returns by investing directly or via SIP.

The threat of investing in cryptos will at all times be there till it’s regulated. Investment Reliable does not offer monetary recommendation, however we do present unbiased information and evaluations on trading, investing, and finance. Also, Piramal Finance has more in-depth, academic, financial-related articles.

The overall price of the ETF fluctuates daily as the price of underlying belongings strikes up and down. And similar to stocks, they’re listed on exchanges and may be traded at any given point. Cryptocurrency operates independently of the inventory market, yet some consultants argue a big link exists between cryptocurrency prices, corresponding to bitcoin, and the stock market. This might unsettle crypto lovers who value its autonomy. Evidence suggests cryptocurrency does influence the inventory market. Cryptocurrency, a worldwide phenomenon in current times, surged to around $3 trillion in whole worth in 2021 earlier than stabilizing at approximately $1.7 trillion, as reported by CoinMarketCap.com.

Mining Bitcoin or serving as a validator in a blockchain community is one of the most hands-on methods to put money into the market. As a reward for their efforts, miners and validators receive cryptocurrency that they could either keep as an investment or commerce for another forex. It allows them to construct diversified portfolios of crypto assets and thereby increase their capital. With automated tracking, they are often assured that their belongings are safe and follow the indexes, making it somewhat beginner-friendly. Cryptocurrency ETFs offer a quantity of advantages to the traders, like low ownership price of holding cryptocurrency and outsourcing the steep studying of trading cryptocurrency.

There is hardly any distinction between cryptocurrency index funds and regular index ones. By defining the latter, the previous shall become implicit. Investing in cryptocurrencies through ETFs provides a number of benefits to investors. Cryptocurrency is a digital forex backed by cryptography, which makes it inconceivable to double-spend or counterfeit. However, most cryptocurrencies are decentralised networks primarily based on blockchain – a ledger system maintained by a disparate pc community system. Before you bounce in, please keep in mind that ETF is a reasonably new kid on the block.

Let us speak about some of the finest ETFs in the market right now. But holding Bitcoin in a regulated ETF creates similar dangers as mentioned above. Cryptocurrency ETFs allow buyers to diversify into these tokens without further costs. What are the advantages and downsides of investing in them?

- Download Black by ClearTax App to file returns out of your cell phone.

- However, the rise of those funds raises questions about their compatibility with the basic ethos of blockchain expertise.

- Many cryptos are stored in a personal wallet which requires a key to access it.

BitSave costs 1.5% as expense ratio, which gets deducted day by day from the NAV. An investor can select to exit the mutual fund anytime, but an exit load of 1% is charged if an investor exits within 30 days of funding. If an exit is initiated, the Seychelles entity would be instructed to sell the tokens in the fund and return the USDT back to the Indian entity, which the consumer can convert back into rupees. So, if you need to take the basket route for investing in cryptocurrency, you are higher off utilizing Coinsets by Mudrex.

Investors who’re busy of their routine, who do not have the financial sense and time, discover it straightforward to invest in mutual funds, which offer nice returns in the long term and are danger diversified. Many financial establishments have foreseen the potential of cryptocurrency. They have taken progressive steps to venture into this new house. For occasion, S&P Dow Jones is launching its personal crypto indexes.

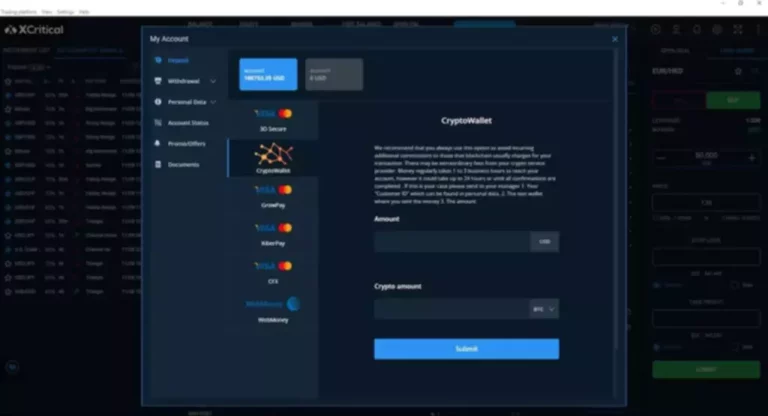

Read more about https://www.xcritical.in/ here.

کددونی | فروشگاه جامع کد، سورس و پروژه

کددونی | فروشگاه جامع کد، سورس و پروژه